A high Debt to Equity ratio can lead to increased interest expenses and financial instability. Companies should aim for a balanced ratio to mitigate these risks while leveraging debt for growth. Investors often scrutinize the Debt to Equity ratio before making investment decisions. A company with a high ratio might be seen as risky, whereas one with a lower ratio could be viewed as more stable. A higher ratio may deter conservative investors, while those with a higher risk tolerance might see it as an opportunity for greater returns. A challenge in using the D/E ratio is the inconsistency in how analysts define debt.

Do you own a business?

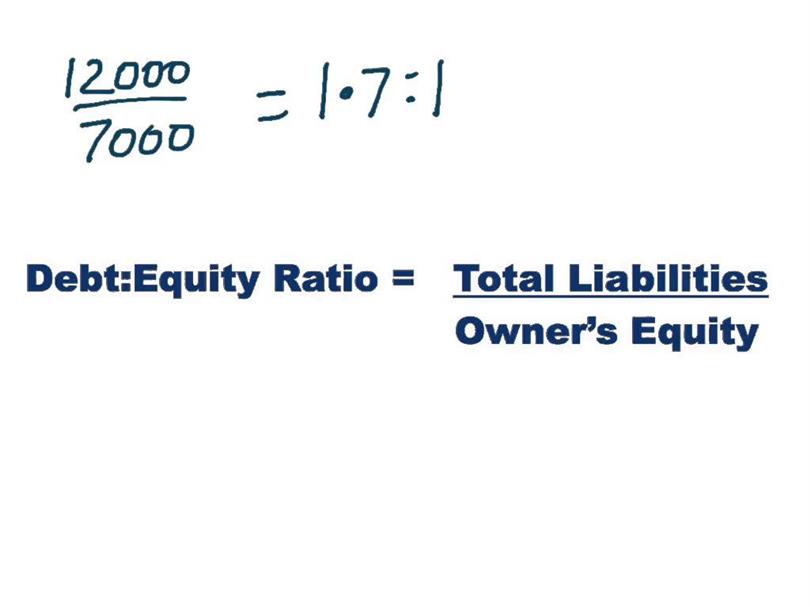

The debt-to-equity ratio or D/E ratio is an important metric in finance that measures the financial leverage of a company and evaluates the extent to which it can cover its debt. It is calculated by dividing the total liabilities by the shareholder equity of the company. Both of these values can be found on a company’s balance sheet, which is a financial statement that details the balances for each account. Investors use the debt to asset ratio to gauge a company’s financial risk. A higher ratio may indicate higher returns due to leveraged growth but also suggests potential vulnerability to economic fluctuations. The debt to asset ratio is an important indicator as it throws light upon health of the company finances with regard to the risk profile.

Is a negative debt-to-equity ratio good?

Investors who want to take a more hands-on approach to investing, choosing individual stocks, may take a look at the debt-to-equity ratio to help determine whether a company is a risky bet. Debt-to-equity ratio is just one piece of the puzzle when it comes to evaluating stocks. Whether the ratio is high or low is not the bottom line of whether one should invest in a company. A deeper dive into a company’s financial structure can paint a fuller picture.

What is the approximate value of your cash savings and other investments?

- For growing companies, the D/E ratio indicates how much of the company’s growth is fueled by debt, which investors can then use as a risk measurement tool.

- In contrast, industries like technology or services, which require less capital, tend to have lower D/E ratios.

- On the other hand, the typically steady preferred dividend, par value, and liquidation rights make preferred shares look more like debt.

- For stakeholders, the level of risk involved in investing or lending to a company also needs to be evaluated.

- This company can then take advantage of its low D/E ratio and get a better rate than if it had a high D/E ratio.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations retail marketing guide to email marketing including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

What Does It Mean for a Debt-to-Equity Ratio to Be Negative?

The D/E ratio is a financial metric that measures the proportion of a company’s debt relative to its shareholder equity. The ratio offers insights into the company’s debt level, indicating whether it uses more debt or equity to run its operations. The Debt to Equity ratio is a financial metric that compares a company’s total debt to its shareholder equity. This issue is particularly significant in sectors that rely heavily on preferred stock financing, such as real estate investment trusts (REITs). A higher ratio suggests that a company is more reliant on debt, which may increase the risk of insolvency during periods of economic downturn.

Is an increase in the debt-to-equity ratio bad?

A company’s accounting policies can change the calculation of its debt-to-equity. For example, preferred stock is sometimes included as equity, but it has certain properties that can also make it seem a lot like debt. The debt-to-equity ratio can clue investors in on how stock prices may move. As a measure of leverage, debt-to-equity can show how aggressively a company is using debt to fund its growth. It is possible that the debt-to-equity ratio may be considered too low, as well, which is an indicator that a company is relying too heavily on its own equity to fund operations. In that case, investors may worry that the company isn’t taking advantage of potential growth opportunities.

So in the case of deciding whether to invest in IPO stock, it’s important for investors to consider debt when deciding whether they want to buy IPO stock. If, on the other hand, equity had instead increased by $100,000, then the D/E ratio would fall. In this example, the D/E ratio has increased to 0.83, which is found by dividing $500,000 by $600,000.

If the company is aggressively expanding its operations and taking on more debt to finance its growth, the D/E ratio will be high. In contrast, service companies usually have lower D/E ratios because they do not need as much money to finance their operations. Tesla had total liabilities of $30,548,000 and total shareholders’ equity of $30,189,000. However, if the company were to use debt financing, it could take out a loan for $1,000 at an interest rate of 5%. There are various companies that rely on debt financing to grow their business.

They do so because they consider this kind of debt to be riskier than short-term debt, which must be repaid in one year or less and is often less expensive than long-term debt. As an example, many nonfinancial corporate businesses have seen their D/E ratios rise in recent years because they’ve increased their debt considerably over the past decade. Over this period, their debt has increased from about $6.4 billion to $12.5 billion (2). As an example, the furnishings company Ethan Allen (ETD) is a competitor to Restoration Hardware. The 10-K filing for Ethan Allen, in thousands, lists total liabilities as $312,572 and total shareholders’ equity as $407,323, which results in a D/E ratio of 0.76. You can find the inputs you need for this calculation on the company’s balance sheet.

If a bank is deciding to give this company a loan, it will see this high D/E ratio and will only offer debt with a higher interest rate in order to be compensated for the risk. The interest payments will be higher on this new round of debt and may get to the point where the business isn’t making enough profit to cover its interest payments. In summary, computing the Debt to Equity ratio is essential for assessing financial health and risk. Companies should regularly evaluate their ratio to ensure it aligns with their strategic goals.